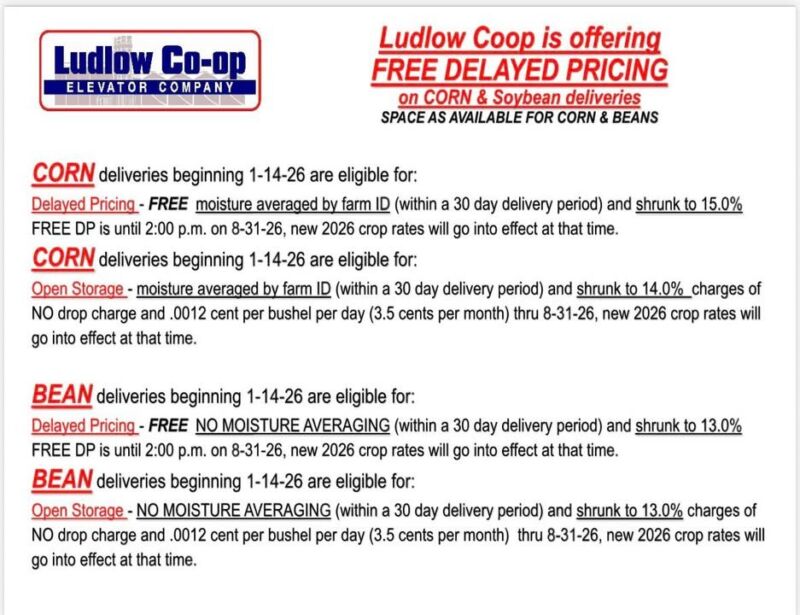

CORN deliveries beginning 1-14-26 are eligible for:

Delayed Pricing – FREE moisture averaged by farm ID (within a 30 day delivery period) and shrunk to 15.0% FREE DP is until 2:00 p.m. on 8-31-26, new 2026 crop rates will go into effect at that time.

CORN deliveries beginning 1-14-26 are eligible for:

Open Storage – moisture averaged by farm ID (within a 30 day delivery period) and shrunk to 14.0% charges of NO drop charge and .0012 cent per bushel per day (3.5 cents per month) thru 8-31-26, new 2026 crop rates will go into effect at that time.

BEAN deliveries beginning 1-14-26 are eligible for:

Delayed Pricing – FREE NO MOISTURE AVERAGING (within a 30 day delivery period) and shrunk to 13.0% FREE DP is until 2:00 p.m. on 8-31-26, new 2026 crop rates will go into effect at that time.

BEAN deliveries beginning 1-14-26 are eligible for:

Open Storage – NO MOISTURE AVERAGING (within a 30 day delivery period) and shrunk to 13.0% charges of NO drop charge and .0012 cent per bushel per day (3.5 cents per month) thru 8-31-26, new 2026 crop rates will go into effect at that time.

SPACE AS AVAILABLE FOR CORN & BEANS

0 CommentsComment on Facebook